When you turn 65 and apply for Medicare benefits from the government the choice seems to be straight forward and simple to complete. Your decisions at this time of your retirement can derail your income later in retirement. Choosing which Medicare plan to take at what monthly cost seems straight forward. Plan A & B. Supplemental Medicare plans purchased thru insurance companies help will the coverage gaps. What if I told you that if you make a certain amount of income after age 65 that your Medicare Plan could cost you more than your neighbor down the street. That is called a Medicare surcharge. What if I told you that a 55 year old couple today would not receive a social security deposit into their bank account every month because the cost of Medicare plans and external expenses would “eat” all the social security income deposits up every month. Would these statements derail your income plan in retirement?

According to a Nationwide study, 76% of retirees surveyed underestimated the external costs in retirement for medical expenses or could not calculate their costs. Medicare only covers about 62% of expenses associated with health care services.

The two factors that contribute to health care expenses rising and taking over your social security income deposits are high inflationary costs and Medicare surcharges to help offset Medicare costs for lower income retirees in the Medicare system.

COLA or cost of living adjustment to social security income has averaged around 2 percent a year for the last ten years with three periods of no increase to COLA. Combine that low social security income increase to the average 8% Medicare increase and you can see why in the longer period that health care expenses such as Medicare premium payments will consume the vast majority of social security income later in life. With well over half of American retirees relying on social security income as their only source of income in retirement this should be a concern going forward.

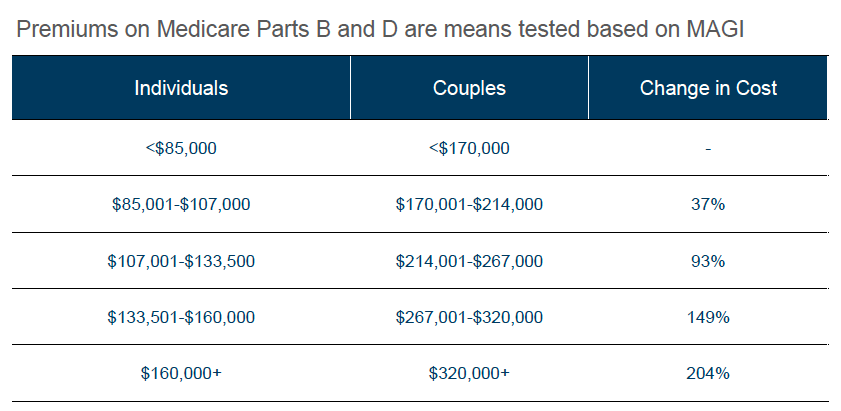

Medicare plan surcharges are based on a MAGI or Modified adjusted gross income schedule for single and couples. MAGI is the total of your household’s adjusted gross income plus any tax-exempt interest income. Examples of tax-exempt income would be life insurance loans, non-qualified annuity income, Roth IRA proceeds and longevity insurance or annuity income.

The Medicare surcharges for a single taxpayer start at $85,000 in yearly MAGI. Surcharge for Medicare premiums for couples start at $170,000. At both of these levels the surcharge is 37% increase than standard Medicare plan cost. These surcharges can increase all the way up to 204%. The key concern is that the surcharge income schedule range is NOT pegged to inflation; so as our earning power increase the schedule stays the same and more retirees will be effected.

For younger people not yet in their sixties these two cost increases will consume more social security income as most retirees count on social security checks to live on. Check out www.Medicare.gov and www.benefitscheckup.org for help on your Medicare benefits.