Why purchase an QLAC or longevity annuity when interest rates are low?

A QLAC or longevity annuity can be a good way for you to diversify your portfolio

and ensure guaranteed, lifetime income that can help you maintain your lifestyle

throughout retirement. But you may have misconceptions about this type

of solution, including whether you should wait for higher interest rates before

purchasing an annuity. Allow me to set the record straight. Interest rates don’t affect annuity payouts as much as you

think. And, the older you get, the less sensitive to interest

rates your annuity payments will be. Lifetime longevity annuity payouts are based on more than interest rates alone. Your lifetime expectancy and that of others in an annuity pool are key factors. Insurance companies

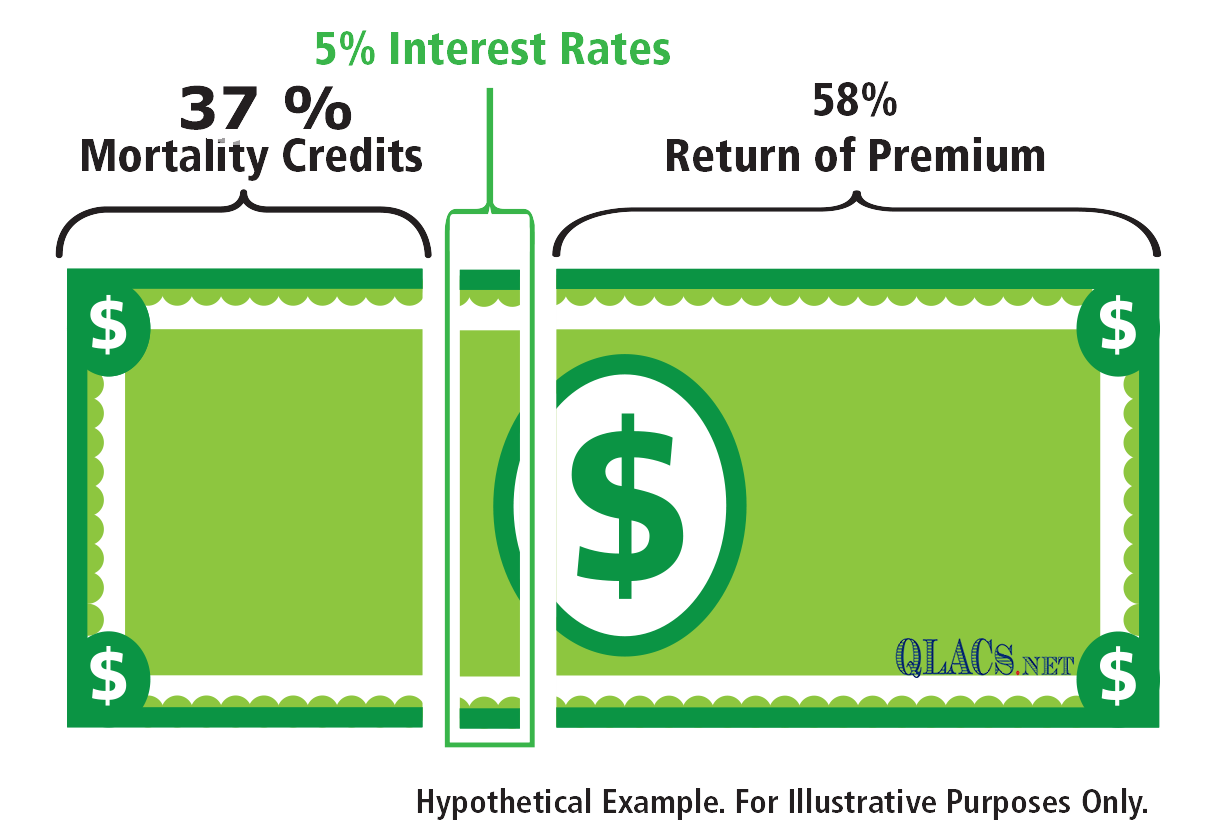

refer to this as mortality credits or longevity credits and use them (along with your premium payments and current interest rates) to determine your lifetime payout amount.

Sample Age: 55 Gender: Male Deferral: 10 Years

Let’s say your longevity annuity or deferred income annuity payment will be

$10,000 per year. How is that payment calculated? Should you wait until interest rates rise to buy?

As you can see, the amount of income you receive based on current interest rates is a small part of your total income payment. And, as you age, more of your annuity payment comes from

mortality credits while the percentage of interest rate income continues to decrease. And if interest rates increased by 50%, say from long term bond rate of 2% increases to 3%, because rates play such a small role, your annuity income payments would only increase by around two percent. Just waiting a year for rates to climb would do more damage as your age increase and lower deferral period would lower payments more likely than the higher rate would give your income payments. The percentage of your payment linked to credits, meanwhile, continues to grow the longer you live and is often higher than you could achieve through individual investments outside of the annuity.